Indexed Point To Point Annuity Accounts

If you own or are considering investing in fixed-indexed annuities, it is important to understand how a point to point annuity sub-account works. In this post, we will discuss how these accounts operate and what investors can expect from them.

Considered the most conservative of most indexed annuity investment options, point-to-point accounts are the least complicated. There are no unusual formulas or difficult calculations to understand. Any money invested in a point to point account will have a beginning and end point that is used to calculate an interest payment.

Indexed Annuity Point To Point Annuity Accounts

Typically, indexed annuities track a market index like the S&P 500, DOW Jones or NASDAQ. Should the tracked index rise, the insurance carrier will take the percentage difference between the beginning and end points in order to calculate an interest credit to the annuity.

For example: Let’s take $100,000 invested in a one year point-to-point account with no cap that tracks the S&P 500. If the value of the S&P 500 was 1500 when you funded your annuity and 1650 one year later, then that would be an increase of 150 points. This translates to a 10% increase.

Assuming no other variables, the point to point annuity would credit 10% interest growth and the account would be worth $110,000 one year later. The account would then reset for a new one year term. If in year two, the S&P 500 dropped back to 1500 from 1650, then no interest would be credited and the account would stay at $110,000 and reset using 1500 as the new starting point for the third year.

Annuity Caps, Spreads And Participation Rates

Other than the beginning and end points, the other factors to consider are any caps, spreads or participation rates that are applied after the term of the account has ended. Most (not all) indexed annuities will have some kind of ceiling or limiting factor on the amount of interest growth that can be credited to the account after the term is over.

If the insurance company had a 6% cap in the one year hypothetical example above, then the account would only have credited 6% in as that would have been the ceiling for growth. After year one, the account would be worth $106,000 (not $110,00) and everything else would remain the same. In other words, you would have only been credited 6% – not the 10% actual growth in the index itself due to the yearly cap.

Other insurance companies will use participation rates or spreads to hedge their risk when issuing a fixed-indexed annuity. Using the same example above with a 50% participation rate and no cap, the owner would only be credited 50%. The growth in the index was 10%, but 50% of that growth (or 5%) was the maximum stipulated in the contract.

On the other hand, a spread a could be 1.5% in a typical indexed annuity. This means that 1.5% of the 10% growth is not credited to the account. Using the example above, the owner would be credited with 8.5% growth (10% – 1.5% spread = 8.5% interest rate) at then end of one year.

Annuity investors should know that most insurance companies will use either a spread, cap or participation rate to calculate yearly interest, but not all three. And these numbers will be known at the beginning of the term – they are not a secret. While they can change from year to year, they are always stated at the beginning of the point to point term.

Annuity Indexing Options, Term Length & Interest

Most annuities offering a point to point sub-account calculate interest over a one year period of time, but there are some accounts that credit interest after a two year (or longer) term. Some can be as long as five years.

The advantage of point to point annuity accounts with longer terms will generally be higher caps, spreads and participation rates. The higher these numbers, the more potential interest growth for the investor.

Most fixed-indexed annuities will track the S&P 500, but there are many that track different indexes or a combination of indexes. Some annuities track the major indexes here in the U.S. and others will offer foreign indexes as an option. More indexing options will provide more opportunity for growth should one area of the economy be performing better than another.

Understanding Fixed-Indexed Annuity Accounts

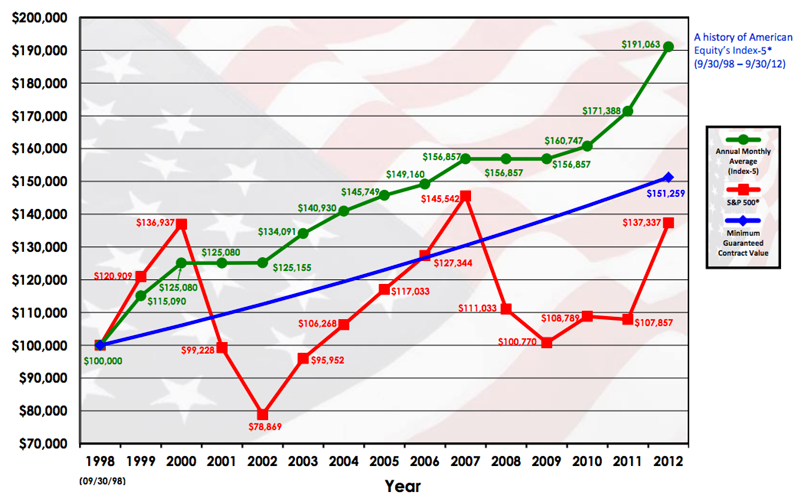

It is important to remember that unlike variable annuities, mutual funds and stocks and bonds – fixed indexed accounts are safe and insured. Any interest gained in an indexed annuity can never be lost due to market fluctuations or corrections. You never own any stocks in the index – indexed annuities are not variable accounts and cannot lose money due to market fluctuations.

Annuity accounts may not make you fabulously wealthy. They are more conservative in nature and are designed to offer higher potential interest than a C.D. (or fixed annuity) without any additional risk to your principal. While interest returns can be in the double digits in very good years, it would be unreasonable to expect an indexed annuity to average double digit returns for the overall term of the contract.

Should you be considering investing in a point to point annuity, contact us and we can help you find the account that best suits your needs and goals.

Category: Annuities, Articles, Retirement Planning

Tags: point to point annuity, point to point indexed annuity

Last updated on January 9th, 2017